Copay And Coinsurance Together

You are here: SafePol>Health Insurance>FAQs>Deductible vs Coinsurance

Copay, Coinsurance and Deductible Example Assume that a plan has a deductible of $1,000, $30 copay and 20% coinsurance. The patient makes her first visit to a doctor in that year. Like every visit, she pays a copay of $30 at the time of the visit. If your plan includes copays, you pay the copay flat fee at the time of service (at the pharmacy or doctor's office, for example). Depending on how your plan works, what you pay in copays may count toward meeting your deductible. Coinsurance What is coinsurance? Coinsurance is a portion of the medical cost you pay after your deductible has been met. Coinsurance is a way of saying that you and your.

Health Insurance, like any other type of insurance, has its own terminology. It is essential to understand it because, without it, a usefulhealth insurance comparisoncannot be made. Below we explain some of the most important health insurance terms so you can make a smart and educated decision when choosing a medical plan.

When you reach it, your insurer will pay for all covered services. OOPM includes copayments, deductible, coinsurance paid for covered services. However, it doesn’t include insurance premiums. OOPM = Copayments + Deductible + Coinsurance. Out-Of-Pocket Maximum in subsidized plans can be lowered by Cost-Sharing Reduction Subsidy. Coinsurance comes into effect once deductibles have been paid. Let us say you have a bill of Rs.10,000 and you have a deductible of Rs.5000. Then coinsurance will be levied on the sum of Rs.5000. Difference between Copay and Deductible. Copay is the fixed amount that you have to pay towards your treatment.

Copays and coinsurance A copay is a fixed amount of money you pay for a certain service. Your health insurance plan pays the rest of the cost. Coinsurance refers to percentages.

Premium

Premium is the amount you pay for insurance. Premiums are usually paid in monthly or quarterly installments.

Copayment

A copayment or copay is a fixed dollar amount you pay for covered medical services or when visiting a doctor. Copayments for primary care providers (PCPs) are usually lower than for visiting specialist doctors. They typically range between $5 – $50 for PCPs and $10 – $100 for specialists. HMO plans tend to have more health care services covered by copayments than PPO plans.

Deductible

A deductible is an amount you pay for eligible medical expenses before your insurance plan starts to pay. If your plan has copayments, for example, for doctors visits or prescription drugs, it is possible you’d pay only the copayment without paying off your deductible first.

Coinsurance

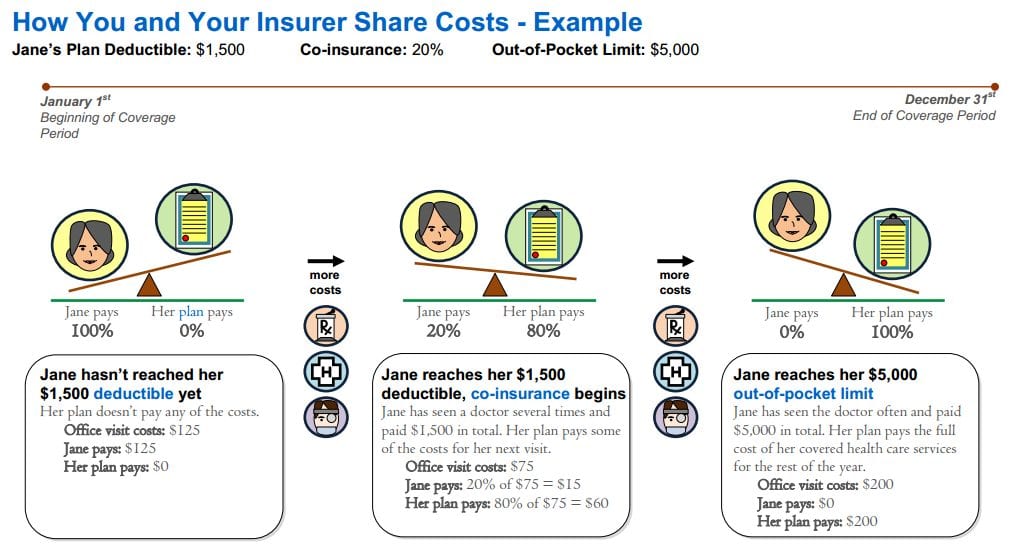

After you meet your deductible, you usually pay coinsurance. Coinsurance is health care costs sharing between you and your insurance company. The coinsurance typically ranges between 20% to 60%. For example, if your coinsurance is 20%, it means you pay 20% for covered health care services, and your insurer pays the remaining 80%. The cost-sharing stops when medical expenses reach your out-of-pocket maximum.

Out-of-Pocket Maximum (OOPM)

Out-Of-Pocket Maximum or Out-of-Pocket Limit is the most you will have to pay for covered medical services in your plan year. When you reach it, your insurer will pay for all covered services. OOPM includes copayments, deductible, coinsurance paid for covered services. However, it doesn’t include insurance premiums.

OOPM = Copayments + Deductible + Coinsurance

Out-Of-Pocket Maximum in subsidized plans can be lowered by Cost-Sharing Reduction Subsidy.

Example of how a typical health insurance plan works

Let’s say you have a health plan with:

- $20 copay for doctor visits

- $1,000 deductible

- 20% coinsurance

- $2,000 OOPM

Let’s say you go to see your doctor. You pay $20 copayment, and your OOPM drops to $1,920.

Next month you have surgery, which costs $15,000. First you pay $1,000 deductible, and your OOPM drops to $920 ( $1,920 – $1,000). The remaining balance to pay for the surgery is $14,000. You pay 20% coinsurance of $14,000, which is $2,800 and your insurance company pays 80% of $14,000, which is $11,200.

Now you will not have to pay the full $2,800 because your OOPM at this point dropped to $920. Therefore, you’ll pay the $920 and the rest $1,880 ($2,800 – $920) will also be paid by your health plan.

Let’s say after the surgery you need rehabilitation. The total cost for the rehabilitation visits and consultations is $2,000. You will pay nothing because you’ve already paid off your OOPM. Your health plan will pay the $2,000.

The above example is just a simple illustration to give you a better understanding of how health plans may work. It assumes that all the medical services are rendered in the same plan year and are provided in your plan’s network. Out-of-network services may not be covered at all or would cost you much more.

In reality, your health insurance policy will have a different copayments, deductible, coinsurance, or OOPM.

What is Copay?

A copay or copayment is the amount of money you are required to pay directly to the healthcare provider (doctor, hospital etc.) per visit, or to a pharmacy for every prescription filled.

Copays discourage unnecessary visits by making the patient responsible for a small portion of her healthcare costs. Copays are typically $15 to $50 per visit but may vary depending upon the following factors:

- Specialists vs. General Physicians: Copays for specialist visits are usually higher than for general physicians.

- Generics vs. brand name drugs: Copays for prescription drugs are around $5 to $20 per prescription, with lower copays for generics vs. brand name drugs. This provides an incentive to lower costs by using drugs that are chemically equivalent but cheaper.

- In-network vs. Out-of-network: Insurance companies contract with healthcare providers to agree upon reimbursement rates. When you see a provider 'in-network' — i.e., a provider that the insurance company has an agreement with — you may pay a lower copay than when you see a doctor out-of-network.

Copays are applicable until the annual out-of-pocket maximum is reached but many insurance plans waive copays for preventive care visits like annual physicals or child wellness checkups.

High-deductible health plans (HDHP) usually do not have a copay.

What is Coinsurance?

The copay is usually too small to cover all of the provider's fees. The provider collects the copay from the patient at the time of service and bills the insurance company. If the provider is in-network, the insurance company first lowers the 'allowed amount' to the pre-negotiated rate for that service (more about this in the example below). If the deductible has been met, the insurance plan then covers a large percentage (usually 60-90%, depending upon the plan) of the allowed amount. The patient is responsible for the balance (10-40% of the allowed amount). This balance is called coinsurance.

Coinsurance may be higher when you see an out-of-network provider, but stays the same whether you see a GP or a specialist.

What is a Deductible?

The annual deductible specified in your plan is the total coinsurance you must pay in a calendar year before the insurance company starts paying for any healthcare costs.

Do copays count toward the deductible?

No, copays do not count toward the deductible. However, copays do count toward the annual out-of-pocket maximum, which is the total amount you are liable to pay for all your healthcare costs in any given year — including copay and coinsurance.

This video explains deductibles, coinsurance and copay:

Copay, Coinsurance and Deductible Example

Assume that a plan has a deductible of $1,000, $30 copay and 20% coinsurance.

The patient makes her first visit to a doctor in that year. Like every visit, she pays a copay of $30 at the time of the visit. Suppose the total bill for that visit is $700. The doctor is in the plan's network so the insurance company gets a discounted rate of $630 for that visit. After subtracting the $30 copay from the patient, the balance owed to the doctor is $600.

If the deductible had been met, the insurance company would have paid 80% of this $600 balance. However, since the deductible has not been met yet, the patient is responsible for the full $600.

Copay And Coinsurance Together Login

The second visit is similar. The doctor's $500 bill is discounted down to $430 because of the preferred rate that the insurance company gets. The patient pays a $30 copay and so the balance is $400. Since the $1,000 deductible has not been met yet, the patient is responsible for this $400 too.

But the $600 from the first visit and the $400 from the second visit total $1,000 and serve to meet the deductible. So for the third visit, the insurance plan steps up and starts paying for healthcare costs.

In our example, the doctor's bill for the third visit is $600, discounted to $530. The patient still pays a $30 copay even after the deductible is met. For the $500 balance, the plans pays 80%, or $400 and the patient is responsible for 20%, or $100.

Other considerations

Navigating the health insurance maze can be challenging because there are other variables involved. For example,

- Some plans have different deductibles for in-network and out-of-network providers.

- Some plans do count copay amounts towards the deductible; most don't.

- Not all plans have an out-of-pocket maximum. For plans that do, you do not have to pay any more copay or coinsurance once you reach that limit in total out-of-pocket expenses for the year, .

- Some plans have a lifetime maximum so the insurance company stops paying for healthcare if they have already paid out that amount over the lifetime of the patient.

- Preventive care such as vaccines for children is usually covered 100%. Copays are waived and deductibles do not apply in such cases.

- Even with a deductible, it is often advantageous to have insurance because of the fee discount negotiated by an insurer with the provider. i.e. the fee that healthcare providers can charge for a particular service is lower if the patient is insured.

Can You Have Both Copay And Coinsurance

References